Media

The media has given our team much recognition.

Nina Nærby is the X-factor judge of the top of the senior executives and non-executives

When large listed companies need external help evaluating their boards, Nina Naerby is frequently called upon. She knows how to increase the board’s effectiveness and how to assess the board members competences…

Read more here (in Danish for subscribers).

Top executives should use their board more actively

Executive management wants to get more value from working with their board. However, executives can do a lot themselves to achieve this, experts say.

Read more here (in Danish for subscribers).

Elite Boards Under Scrutiny: Here Are the Strengths, Weaknesses – and Surprises

162 board members from C25 companies mapped out. Where are the most women? The most international profiles? Where are the oldest and youngest members – and where are the most members with top executive experience? A new analysis provides the answers.

Read more here (in Danish for subscribers).

Shareholders choose more non-Danish than Danes for C25-boards

Boards in C25 have increased their share of non-Danish and female board members. However, they are missing competences in HR, Innovation, and IT, according to an expert.

Read more here (in Danish for subscribers).

Big, listed companies skimp the evaluation of their boards

New analysis from Board advisors: Fewer of the large, listed companies comply with the corporate governance code about how to report board evaluations.

Read more here (in Danish for subscribers).

Boards spend most of their time on the least important subject

Do you think that boards spend most of their time talking about the future? If this is your overall perception of board work, you can start revising it. Boards spend most of their time talking about the past. The latest report reveals that many boards have challenges in creating effective agendas for their work.

Read more here (in Danish for subscribers).

Women in management are stuck in the pink ghetto

Positions like CEO and CFO are overwhelmingly dominated by men, whereas women are in the majority in HR and communication job roles.

Former top headhunter and current board advisor Nina Nærby, founder of the company Leadership Advisor Group… explains why there are still very few women who become board chairmen, top managers or CFOs:

"Many of the current board members themselves have a past as CEO or CFO, and they will often have a tendency to point to candidates who have the same background. This is what is called "affinity bias" - we prefer people who are similar to ourselves," says Nina Nærby.

She advocates that the boards consciously begin to strengthen themselves with members who have, for example, HR, IT, law, research, or similar specialties as a professional background.

Read more here (in Danish for subscribers).

The musical-chair game is starting – which of the board members will be replaced at the upcoming general meetings?

Leading boards identify which competencies they have vs. what they need to meet the company’s upcoming challenges. These competencies go beyond experience, gender and nationality, including aspects like having a variety of working styles. Read the interview with us in the recent Borsen article and contact us if you’d like to hear how your board could consider improving its composition. This shouldn’t be a taboo subject – top companies are learning the value of having an open conversation about what the board has vs. what it needs for the future.

Read more here (in Danish for subscribers).

Huey, Dewie, Louie effect clear on C25 boards

Herd mentality flourishes in boards. They continue to recruit new members who match their own profile. The consequence is that the boards lack skills that are critical for the company, new analysis shows

Read more here (in Danish for subscribers).

The talent pipeline gets smaller at the top

Danish businesses have lost focus on the food chain, and that risks thinning the pipeline of women for top posts. While representation of women is beginning to improve at board level for the largest public companies, achievement of better gender balance on executive and top management teams has been much slower.

Read more here (in Danish for subscribers).

Work on culture, purpose and remuneration policies awaits boards in the coming years

It is not just the work with ESG that will fill the boards’ agenda in the coming years. Global trends are on the way to the Danish boardrooms, says Nina Nærby, CEO of Leadership Advisor Group, who advises leadership and specializes in board evaluations.

Read more here (in Danish for subscribers).

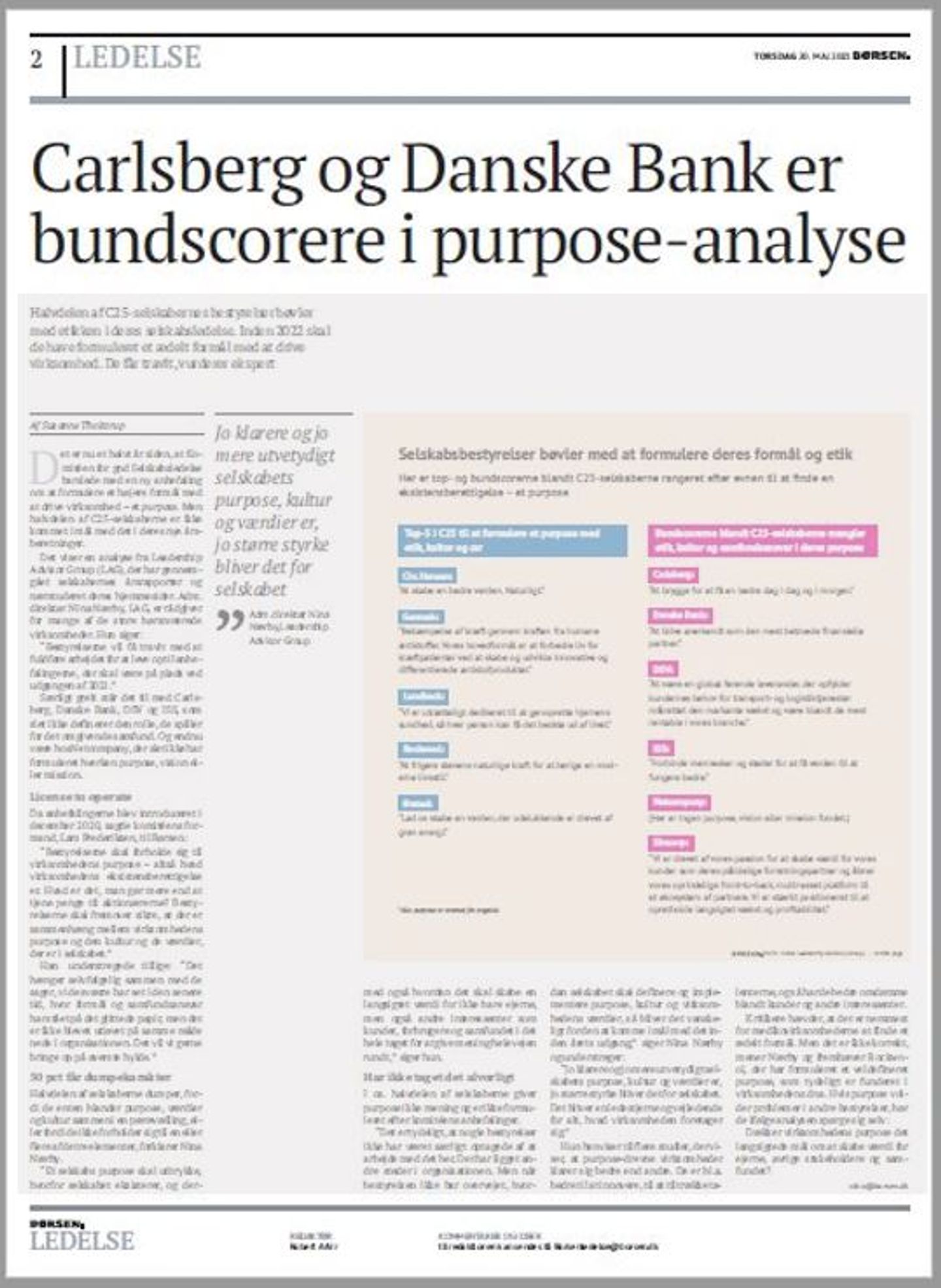

Carlsberg and Danske Bank score at the bottom on purpose analysis

Half of the C25 companies’ boards are not in line to have formulated a meaningful purpose by 2022. Experts say they will be busy. According to a new analysis from Leadership Advisor Group (LAG), which as thoroughly reviewed the annual reports and websites of these companies, “Boards will be busy getting the work done to live up to the (new corporate governance) recommendations” – Nina Nærby, Managing Director for Leadership Advisor Group and advisor for several large Danish and foreign company boards.

Read more here:

Chairmen not taking responsibility for getting women onto top management teams

New research shows that gender balance at the top of the large publicly listed Danish companies is moving slowly. Chairmen and boards seem to be neglecting their role in implementing diversity. While 36% of board members are female, the same is true for only 13% of executive management teams.

According to Nina Nærby, Managing Director for Leadership Advisor Group and advisor for several large Danish and foreign company boards, boards have gotten off too easily in terms of following up on companies’ implementation of diversity policies. Boards are responsible for diversity at the top management level. One can wonder whether some are intentionally setting such broad goals that it is impossible to see how women are being recruited for this top level.

Nina Nærby’s advice: “Shareholders should demand that numerical goals are set for the executive management team, and that clear reporting is done both on the results and on the ongoing activities to reach the goals”. Read more here:

Lack of diversity among Denmark’s most powerful board chairmen: 1 non-Dane – and no women

In Denmark, diversity is an iceberg that needs to be melted…not just with regard to gender, but also nationality and age. Studies from both the IMF and McKinsey show a significant relation between gender diversity in top management or board of directors, and higher profitability.

According to Nina Nærby, Managing Director for Leadership Advisor Group and advisor for several large Danish and foreign company boards, the problem is rooted in the low number of female top managers in Denmark, as top level leadership experience is critical when choosing board members. Read more here:

Three headhunters hunt for top leaders for boards: here’s what they are looking for

An interview with three headhunters who are actively working with the boards of the biggest companies, shows they are looking for CEOs and CFOs who think digitally and sustainably, as well as who are able at the same time, to handle the task of building the right culture in these companies. Many of these boards are not prepared to match the agenda that shareholders and customers now demand. Therefore, we are likely to see board turnover. Read more here:

Only one in five Danish C25 boards complies with the recommendations

The guidelines from the Committee for Good Corporate Governance recommend that boards should be evaluated every year and the results written up on their website’s home page and annual report, but only 20% of the C25 are managing to do this with robust quality. “In reality it should not be a difficult task” says Nina Naerby from Leadership Advisor Group, the company who has done the analysis.

New demands on salary transparency and sustainability

For the first time in four years, the powerful Danish Committee for Good Corporate Governance has updated its recommendations, and at the same time increased focus on (among other areas) social responsibility and management remuneration.

The recommendations are not “law”, but most companies follow them, especially the large publically traded companies. According to Nina Næerby, Managing Director for Leadership Advisor Group and advisor for several large Danish and foreign company boards, the recommendations are followed partly because the Committee includes members with board experience who want to ensure the best for companies, but also because most companies realize that if the soft recommendations are not followed, there is a risk of them becoming hard law.

Read more in the article here (paywall/subscription):

No more hiding behind the figleaf for the board of directors

From January 2021, it will become the board’s responsibility to become involved in the company’s purpose (what the company does besides earning money for shareholders) and in ensuring alignment between the purpose and the company culture and values. The board will also become responsible for ensuring all decisions are made with sustainability in mind. These changes to the guidelines are the result of too many examples of companies where purpose and social responsibility have “looked nice on paper” but have not been practiced down through the organization.

“The whole mindset around sustainability and purpose is now not just an internal matter, but also aimed at the external stakeholders. This helps both recruiting and retention of the most skilled employees…” says Nina Nærby. “Many C25 companies have not had a very clear or relevant purpose, while companies such as Lundbeck, Rockwool and Chr. Hansen have held purpose as a guiding star for many years.”

Nina Nærby is also satisfied that the Danish Committee for Good Corporate Governance has tightened the recommendations on board evaluation, making it more explicit that there should be an external evaluation of each individual board member at least every third year. This makes each member’s value creation on the board more visible. Read more in the article here:

Increasing diversity on the boards of Danish C25 companies

There is a noticeable increase in diversity on the boards of Denmark’s largest companies. Non-Danes and women have found their way to board positions, but there is still a need to promote women into leadership roles before equality can truly be achieved…

Board evaluations in Denmark are a bit like the wild west

Never before have so many boards’ of listed companies been evaluated in order to comply with good corporate governance. But many board evaluation reports are not worth the paper they are written on…

Interested in self-evaluation? Try Online Board Evaluations

Well-aligned with national corporate and foundation/charity governance codes, our board clients usually conduct an external board evaluation every three years. However, most national governance codes recommend that boards perform a self-evaluation in the years between external board evaluations. Therefore, we have developed OnlineBoardEvaluations.com, a tool enabling boards to self-evaluate effectively and effortlessly every year.